Governor Brad Little has acted on all of the bills delivered to his desk from the 2020 legislative session. During the session, the governor has five days—not counting Sundays—to act on bills. He can either sign them into law, veto them, or allow them to become law without his signature. The end of the session extends that deadline to ten days.

Read MoreOn Friday, Governor Brad Little announced additional executive measures to assist Idaho’s response to the 2019 novel coronavirus, or COVID-19. Through executive order, he is directing a $39.3 million transfer from the Tax Relief Fund to the Disaster Emergency Account.

What is the Tax Relief Fund?

Read MoreSpring is in the air, and Idaho legislators are itching to wrap up and return home for the year. Their target date for the end of session has been March 20, which means bills are moving quickly at the capitol. Lawmakers are trying to push that adjournment date even earlier amid concerns over the spread of novel coronavirus.

Read MoreAfter three days of hearings and hours of testimony from county and city officials, an Idaho House panel has approved a bill that would temporarily freeze the portions of local government budgets funded by property taxes. The House Revenue and Taxation Committee approved the bill last week with a do pass recommendation on a 12-3 party line vote.

The bill prohibits local governments—except for school districts—from certifying a property tax budget or levy in 2020 that exceeds the amount budgeted in 2019.

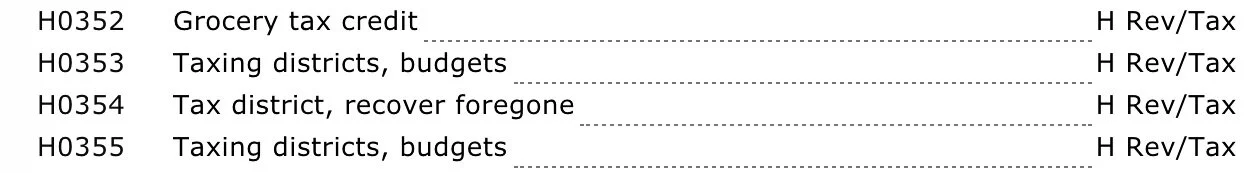

Read MoreThe House Revenue & Taxation Committee is gearing up to consider this year’s tax proposals. Wednesday’s hearing saw the introduction of several bills aimed at property and grocery taxes.

“It doesn’t necessarily mean that your property taxes are going to go down,” said House Majority Leader Mike Moyle. “It puts a Band-Aid on it, and it gives the opportunity for those of us in the Legislature to sit down and find out a way to proceed with this.”

Read More